Unlock Your Dream Home With Smart Savings: A Powerful Click To Action For House Purchase

Savings Purchase House

Introduction

Dear Readers,

3 Picture Gallery: Unlock Your Dream Home With Smart Savings: A Powerful Click To Action For House Purchase

Welcome to our article about savings for purchasing a house. In today’s competitive real estate market, it is important to have a solid savings plan in order to achieve your dream of owning a home. In this article, we will explore the various aspects of saving for a house purchase, including the importance of saving, strategies to save effectively, and the benefits and drawbacks of this approach. So, let’s delve into the world of savings for purchasing a house and discover how you can make your dream a reality.

What is Savings Purchase House?

Image Source: cnbcfm.com

🏠 Saving for a house purchase refers to the act of setting aside money over a period of time in order to accumulate enough funds to buy a property. It involves budgeting, cutting expenses, and implementing a disciplined approach towards saving. By saving for a house purchase, individuals aim to have enough money for a down payment, closing costs, and other expenses associated with buying a house.

Who Should Save for a House Purchase?

🏠 Saving for a house purchase is a goal that can be pursued by anyone who wishes to become a homeowner. It is especially beneficial for individuals who do not have sufficient funds to purchase a house outright or do not want to rely on financing options. Whether you are a young professional looking to invest in your future or a family planning to settle down, saving for a house purchase can be a smart financial decision.

When Should You Start Saving?

🏠 The ideal time to start saving for a house purchase is as early as possible. The earlier you start, the more time you have to accumulate the necessary funds. However, it is never too late to begin saving. Whether you are in your early twenties or nearing retirement, it is important to evaluate your financial situation and set a realistic timeline for achieving your house purchase goal.

Where Can You Save?

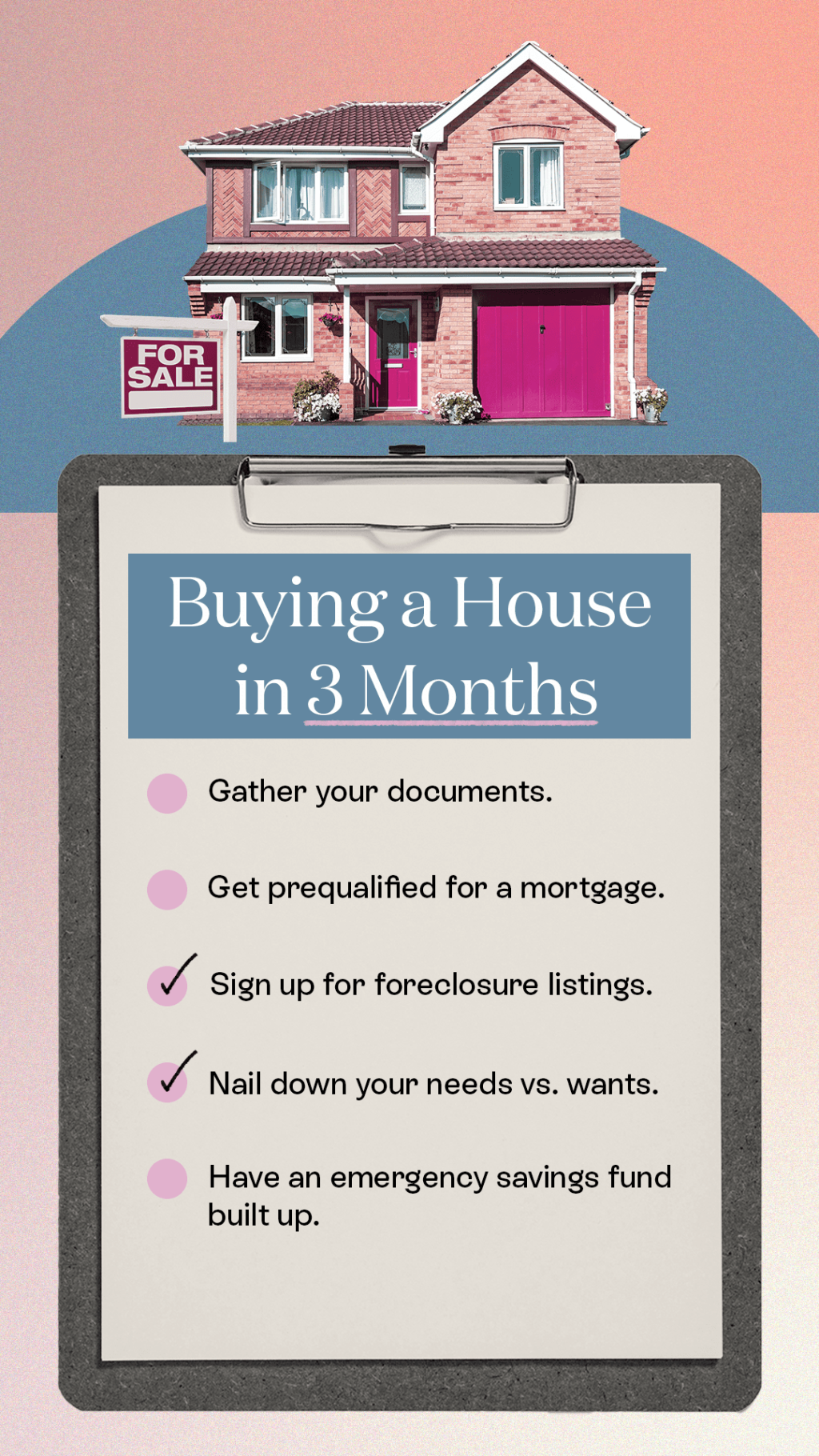

Image Source: cnn.com

🏠 When it comes to saving for a house purchase, there are various options available. One common approach is to open a dedicated savings account specifically for this purpose. This allows you to separate your house purchase funds from your regular savings and track your progress more effectively. Additionally, you can explore other investment options such as fixed deposits or mutual funds to potentially grow your savings over time.

Why is Saving for a House Purchase Important?

🏠 Saving for a house purchase is important for several reasons. Firstly, it helps you build financial discipline and develop a habit of saving. It also allows you to accumulate a significant amount of money that can be used towards your dream of homeownership. Moreover, saving for a house purchase can help you avoid excessive borrowing and reduce the burden of mortgage payments in the long run.

How Can You Save for a House Purchase?

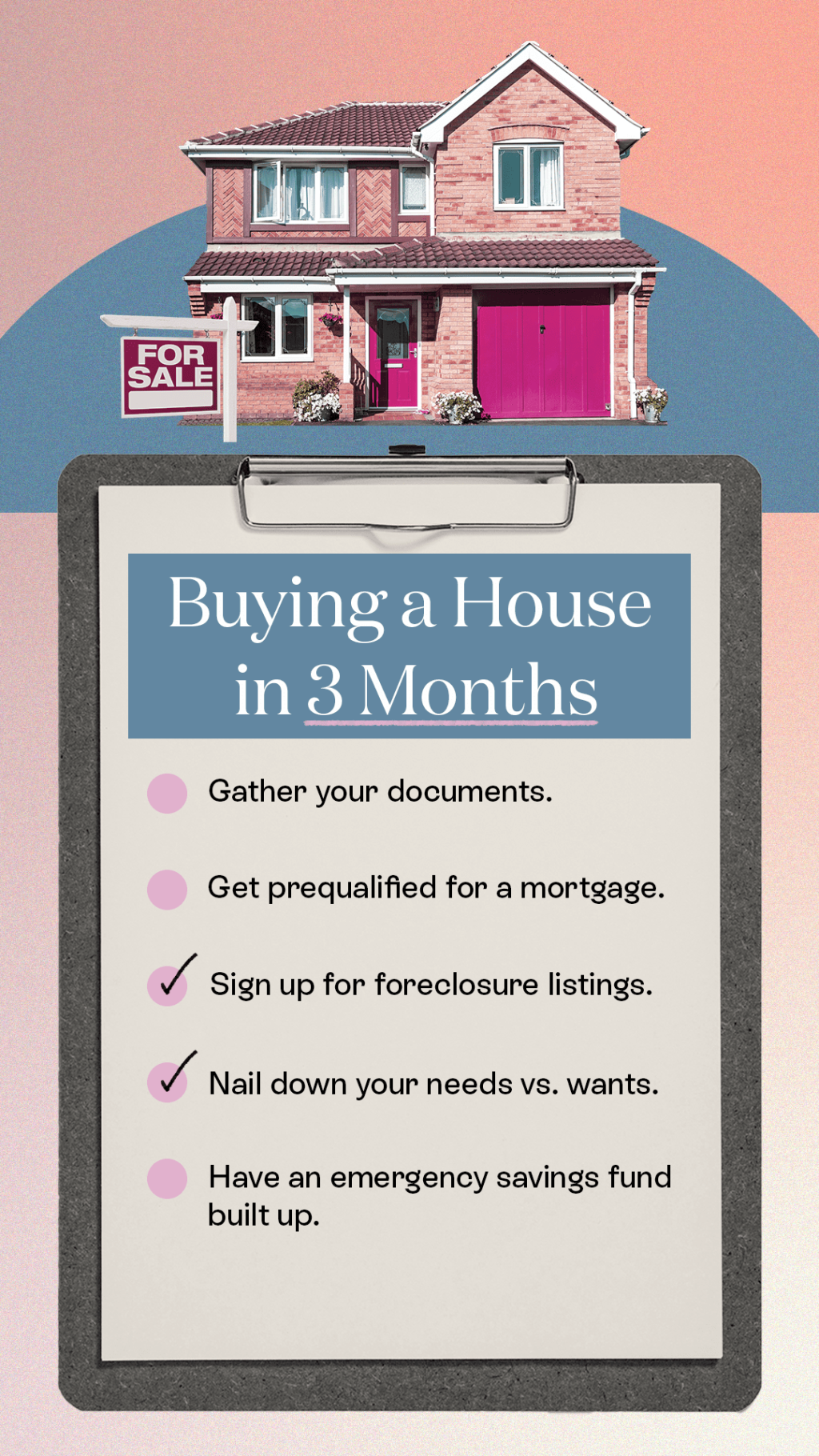

Image Source: apartmenttherapy.info

🏠 Saving for a house purchase requires a strategic approach. Firstly, you should set a realistic savings goal based on the cost of the house you wish to purchase. This will help you determine the amount you need to save each month. Secondly, it is important to create a budget and cut unnecessary expenses to free up more money for savings. Additionally, you can explore ways to increase your income, such as taking on a side job or freelancing. Lastly, it is crucial to stay disciplined and consistently contribute to your savings.

Advantages and Disadvantages of Saving for a House Purchase

Advantages:

1. 🏠 Building Equity: By saving for a house purchase, you are building equity in a tangible asset that can appreciate over time.

2. 🏠 Financial Freedom: Owning a house outright provides financial stability and freedom from monthly rent or mortgage payments.

3. 🏠 Pride of Ownership: Owning a home gives you a sense of pride and accomplishment, as it is a significant milestone in life.

Disadvantages:

1. 🏠 Time-consuming: Saving for a house purchase requires time and patience, as it may take several years to accumulate enough funds.

2. 🏠 Limited Options: Saving for a house purchase may limit your options in terms of location, size, or features, as you may be restricted to properties within your budget.

3. 🏠 Opportunity Cost: Saving for a house purchase means tying up your funds, which could have been invested in other potentially profitable ventures.

Frequently Asked Questions (FAQs)

1. Can I save for a house purchase while paying rent?

Yes, it is possible to save for a house purchase while paying rent. By creating a budget and cutting expenses, you can allocate a portion of your income towards savings, even if you are currently renting a property.

2. How much should I save for a house purchase?

The amount you should save for a house purchase depends on various factors, including the cost of properties in your desired location and your financial situation. It is advisable to save at least 20% of the property’s value as a down payment to avoid private mortgage insurance.

3. Can I use my retirement savings for a house purchase?

While it is possible to use your retirement savings for a house purchase, it is generally not recommended. Withdrawing funds from your retirement accounts may result in penalties and taxes, and it can negatively impact your long-term financial security.

4. Are there any government programs or incentives for saving for a house purchase?

Yes, some governments offer programs and incentives to encourage saving for a house purchase. These programs may include tax benefits, grants, or low-interest loans. It is advisable to research and explore such options in your country or region.

5. How long does it usually take to save for a house purchase?

The time it takes to save for a house purchase varies depending on factors such as your income, expenses, and savings rate. It can take several years to accumulate enough funds, but with a disciplined savings plan, it is possible to achieve your goal within a reasonable timeframe.

Conclusion

In conclusion, saving for a house purchase is a significant financial goal that requires careful planning and discipline. By starting early, setting realistic goals, and taking a strategic approach, you can make your dream of owning a house a reality. While there are advantages and disadvantages to this approach, the long-term benefits of homeownership often outweigh the challenges. So, take control of your finances, start saving, and embark on the journey towards purchasing your dream home.

Final Remarks

Dear Readers,

It is important to note that the information provided in this article is for educational purposes only. Before making any financial decisions, it is advisable to consult with a qualified financial advisor or seek professional guidance. Saving for a house purchase requires careful consideration of your individual circumstances, and what works for one person may not be suitable for another. Remember to evaluate your financial goals and options in order to make an informed decision regarding your house purchase savings plan. Good luck on your journey to homeownership!

This post topic: Shopping Savings