Unlock Your Financial Future With Retail Savings Bonds By The Government Of South Africa: Take Action Now!

Retail Savings Bonds Government South Africa: Secure and Profitable Investment Options

Introduction

Dear Readers,

Welcome to our in-depth guide on retail savings bonds offered by the government of South Africa. In this article, we will explore the various aspects of retail savings bonds, including what they are, who can invest in them, when and where to invest, why they are a valuable investment option, and how to get started. By the end of this article, you will have a comprehensive understanding of retail savings bonds and be equipped to make informed investment decisions.

2 Picture Gallery: Unlock Your Financial Future With Retail Savings Bonds By The Government Of South Africa: Take Action Now!

Now, let’s dive into the details and uncover the benefits and intricacies of retail savings bonds in South Africa.

Table of Contents

1. What are Retail Savings Bonds? 🧐

Image Source: yfm.co.za

2. Who can Invest in Retail Savings Bonds? 🤔

3. When to Invest in Retail Savings Bonds? ⏰

4. Where to Invest in Retail Savings Bonds? 🌍

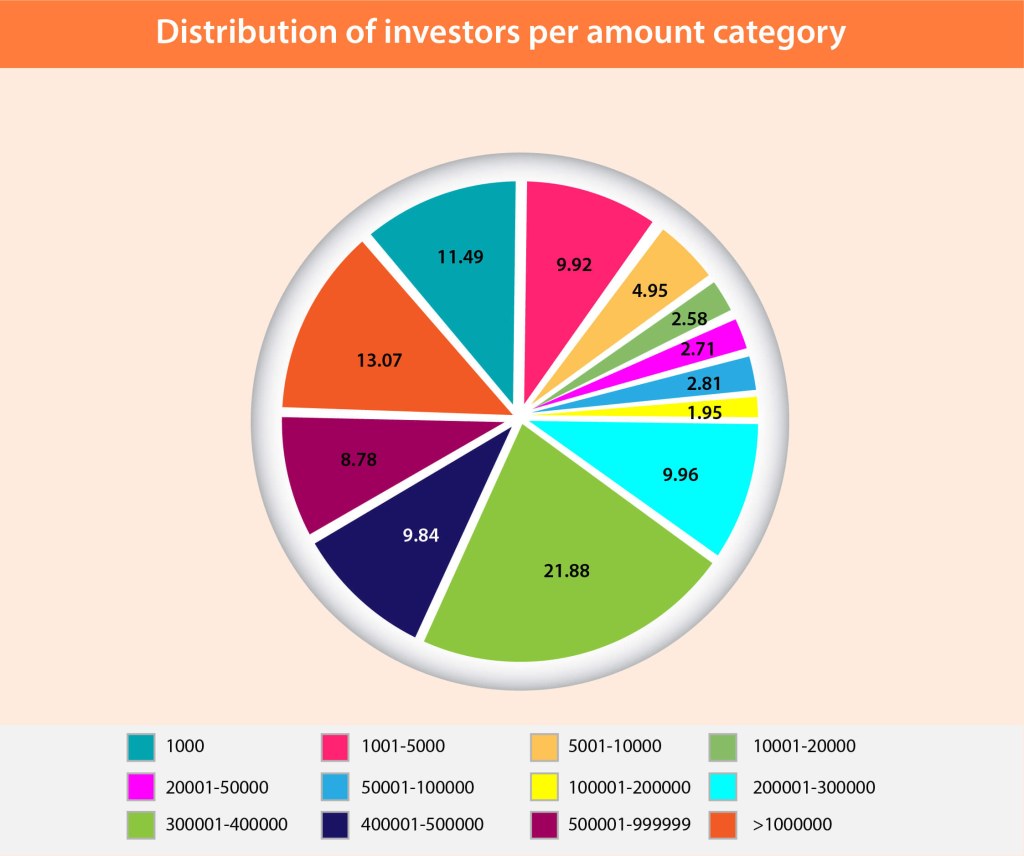

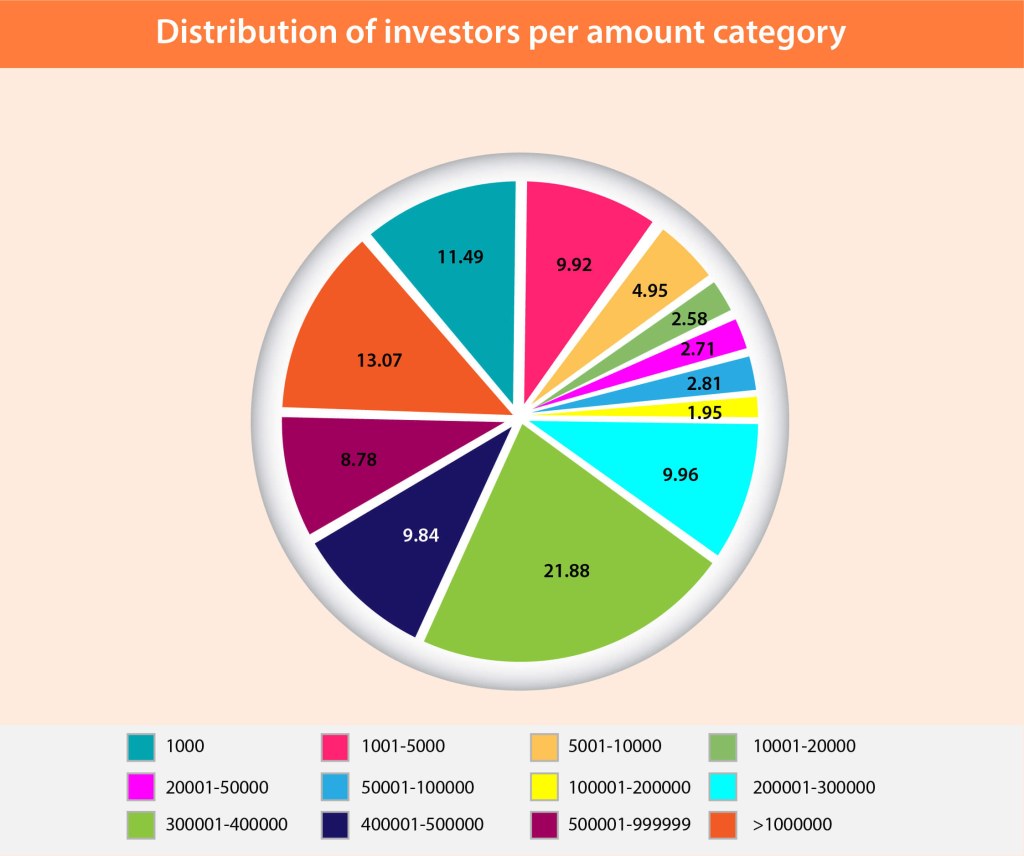

Image Source: rsaretailbonds.gov.za

5. Why Choose Retail Savings Bonds? 📈

6. How to Invest in Retail Savings Bonds? 📊

7. Advantages and Disadvantages of Retail Savings Bonds 🎯

8. Frequently Asked Questions (FAQs) ❓

9. Conclusion 🏁

10. Final Remarks and Disclaimer 📝

1. What are Retail Savings Bonds? 🧐

Retail savings bonds are government-issued investment instruments that allow individuals to lend money to the South African government in exchange for regular interest payments. They are a safe and secure way to invest money while earning a fixed return over a specific period of time. These bonds are available to both South African citizens and non-residents, providing an inclusive investment opportunity.

Investing in retail savings bonds not only helps individuals grow their savings but also contributes to the development of the country by supporting government initiatives and infrastructure projects.

Key Points:

Retail savings bonds are government-issued investment instruments.

They offer a secure way to invest money with a fixed return.

Available to South African citizens and non-residents.

Support government initiatives and infrastructure projects.

2. Who can Invest in Retail Savings Bonds? 🤔

Retail savings bonds are accessible to a wide range of individuals, including individuals, trusts, minors, and corporate entities. The eligibility criteria for investing in retail savings bonds are as follows:

Individual Investors:

Any individual who is a South African citizen or resident, 18 years or older, can invest in retail savings bonds. The bonds can be purchased individually or jointly with another person.

Trusts:

Trusts registered in South Africa can also invest in retail savings bonds. The trustees must provide the necessary documentation and comply with the regulations set by the government.

Minors:

Parents or guardians can invest on behalf of minors, ensuring a secure financial future for their children. The bonds can be transferred to the minor’s name once they reach the age of 18.

Corporate Entities:

Corporate entities, such as companies and closed corporations, can invest in retail savings bonds. They need to provide the required documentation and comply with the regulations set by the government.

Overall, retail savings bonds offer a flexible investment option that caters to a diverse range of investors. Whether you are an individual looking to grow your savings or a corporate entity seeking a secure investment avenue, retail savings bonds can be an excellent choice.

3. When to Invest in Retail Savings Bonds? ⏰

Timing plays a crucial role in maximizing the returns from retail savings bonds. The South African government regularly issues new bond series, each with its own interest rate and maturity period. It is important to pay attention to the launch dates of new series to take advantage of the most favorable terms.

Additionally, it is advisable to invest in retail savings bonds when you have excess funds that you do not require in the short term. As these bonds have a fixed maturity period, typically ranging from 2 to 5 years, it is important to align your investment horizon with the bond’s maturity to optimize returns.

Key Points:

Pay attention to the launch dates of new bond series.

Invest excess funds for the long term to align with the bond’s maturity.

4. Where to Invest in Retail Savings Bonds? 🌍

Retail savings bonds can be conveniently purchased online through the government’s official website or through authorized financial institutions. The South African government has established a user-friendly online platform that allows investors to easily browse through available bond series, compare interest rates, and make secure investments.

Alternatively, investors can visit their local bank or financial institution to inquire about retail savings bonds and complete the investment process. It is important to ensure that the chosen institution is authorized to facilitate retail savings bond transactions.

Investors can also seek guidance from financial advisors or wealth managers who specialize in retail savings bonds to make informed investment decisions.

Key Points:

Purchase bonds online through the government’s official website or authorized financial institutions.

Visit local banks or financial institutions for in-person assistance.

Consider consulting with financial advisors or wealth managers for guidance.

5. Why Choose Retail Savings Bonds? 📈

There are several compelling reasons to choose retail savings bonds as a investment option:

Secure and Low-Risk Investment: Retail savings bonds are backed by the South African government, making them a safe and reliable investment option. The government is committed to fulfilling its repayment obligations, ensuring the security of your investment.

Steady Income Stream: Retail savings bonds provide regular interest payments, which can be a valuable source of income. These interest payments are typically made bi-annually or annually, depending on the bond series.

Predictable Returns: Unlike other investment options, retail savings bonds offer a fixed interest rate throughout the bond’s tenure. This predictability allows investors to accurately forecast their returns and plan their finances accordingly.

Ease of Access: Investing in retail savings bonds is a hassle-free process. With online platforms and authorized financial institutions, investors can easily access and manage their bond investments.

Social Impact: By investing in retail savings bonds, individuals contribute to the development of South Africa. The funds raised through these bonds are utilized for various government initiatives, such as infrastructure development, education, and healthcare.

Capital Preservation: Retail savings bonds offer the option to reinvest the interest payments, compounding the returns over time. This feature allows investors to preserve their capital while enhancing their overall returns.

Tax Benefits: Interest earned from retail savings bonds is exempt from income tax, making them a tax-efficient investment option. This can significantly enhance the overall returns for investors.

Considering these advantages, retail savings bonds emerge as a compelling investment option for individuals seeking a secure and profitable avenue to grow their wealth.

6. How to Invest in Retail Savings Bonds? 📊

Investing in retail savings bonds is a straightforward process that involves a few simple steps:

Step 1: Determine Your Investment Amount

Decide on the amount you wish to invest in retail savings bonds. Consider your financial goals, risk appetite, and investment horizon to determine an appropriate amount.

Step 2: Research Available Bond Series

Explore the various bond series available and compare their interest rates, maturity periods, and other relevant details. This research will help you select the most suitable bond for your investment needs.

Step 3: Complete the Application

Fill out the application form provided by the government or authorized financial institution. Provide accurate personal and financial information as required.

Step 4: Submit the Application

Submit the completed application form along with any necessary supporting documents to the designated authority. Ensure all documents are duly signed and witnessed, if required.

Step 5: Make the Investment

Transfer the investment amount to the specified bank account or follow the instructions provided by the government or financial institution. Retain the payment confirmation for future reference.

Step 6: Monitor Your Investment

Keep track of your retail savings bond investment through the online platform or periodic statements provided by the financial institution. Stay informed about interest payments, maturity dates, and other relevant updates.

Following these steps will ensure a seamless investment experience and allow you to benefit from the potential returns offered by retail savings bonds.

7. Advantages and Disadvantages of Retail Savings Bonds 🎯

Like any investment option, retail savings bonds have their own advantages and disadvantages. Let’s explore both sides to help you make an informed decision:

Advantages:

Secure and low-risk investment.

Regular income stream through interest payments.

Predictable returns with fixed interest rates.

Ease of access through online platforms and authorized financial institutions.

Contribute to the development of South Africa.

Option to reinvest interest payments for compounding returns.

Tax benefits with exemption from income tax.

Disadvantages:

Lower potential returns compared to riskier investments.

Fixed interest rates may not keep up with inflation.

Maturity periods restrict access to funds for a specific duration.

Interest payments subject to interest rate fluctuations.

Market conditions may affect the resale value of bonds.

It is important to evaluate these advantages and disadvantages based on your individual financial goals, risk tolerance, and investment horizon.

8. Frequently Asked Questions (FAQs) ❓

1. Can non-residents of South Africa invest in retail savings bonds?

Yes, non-residents of South Africa can invest in retail savings bonds. They need to comply with the eligibility criteria set by the government and provide the necessary documentation.

2. Are retail savings bonds guaranteed by the government?

Yes, retail savings bonds are backed by the South African government. The government is committed to repaying the invested amount along with the agreed-upon interest.

3. What is the minimum investment amount for retail savings bonds?

The minimum investment amount for retail savings bonds is typically set at ZAR 1,000. However, it is advisable to check the specific requirements for each bond series.

4. Can I sell my retail savings bonds before maturity?

Retail savings bonds are not actively traded in the secondary market. However, you can request an early redemption of your bonds under certain circumstances, subject to applicable fees and penalties.

5. How are the interest payments from retail savings bonds taxed?

Interest earned from retail savings bonds is exempt from income tax in South Africa. Therefore, investors do not need to pay tax on the interest payments received.

9. Conclusion 🏁

Dear Readers,

Throughout this article, we have explored the world of retail savings bonds offered by the government of South Africa. We have learned about the advantages of investing in these bonds, the eligibility criteria, the investment process, and the potential returns they offer.

Investing in retail savings bonds can be a wise decision, providing you with a secure and predictable income stream while contributing to the development of South Africa. However, it is important to carefully consider your financial goals, risk tolerance, and investment horizon before making any investment decisions.

We hope this article has provided you with valuable insights and empowered you to make informed investment choices. Should you have any further questions or require additional information, please do not hesitate to reach out to us.

Happy investing!

10. Final Remarks and Disclaimer 📝

Dear Readers,

Before concluding this article, we would like to provide a final set of remarks and a disclaimer.

Firstly, retail savings bonds offered by the government of South Africa are subject to change in terms and conditions. It is essential to stay updated with the latest information provided by the government and authorized institutions.

Secondly, while retail savings bonds are considered a secure investment option, they still carry risks. It is important to assess your risk tolerance and diversify your investment portfolio accordingly.

Lastly, the information provided in this article is for educational purposes only and should not be considered financial or investment advice. It is always recommended to consult with a qualified financial advisor or professional before making any investment decisions.

Thank you for your time and attention. We hope you found this article informative and useful for your investment journey.

Best regards,

Your Name

This post topic: Shopping Savings