Empower Your Finances With Unleashed Purchasing Power Savings: Take Action Now!

Purchasing Power Savings: Maximizing Your Buying Potential

Introduction

Hello Readers,

1 Picture Gallery: Empower Your Finances With Unleashed Purchasing Power Savings: Take Action Now!

Welcome to an informative article on purchasing power savings. In today’s fast-paced world, it is crucial to make the most of our hard-earned money. By understanding and implementing effective strategies for purchasing power savings, we can enhance our buying potential and achieve financial stability. In this article, we will explore the concept of purchasing power savings, its importance, and how it can benefit you as a consumer. So, let’s dive in!

What is Purchasing Power Savings? 💰

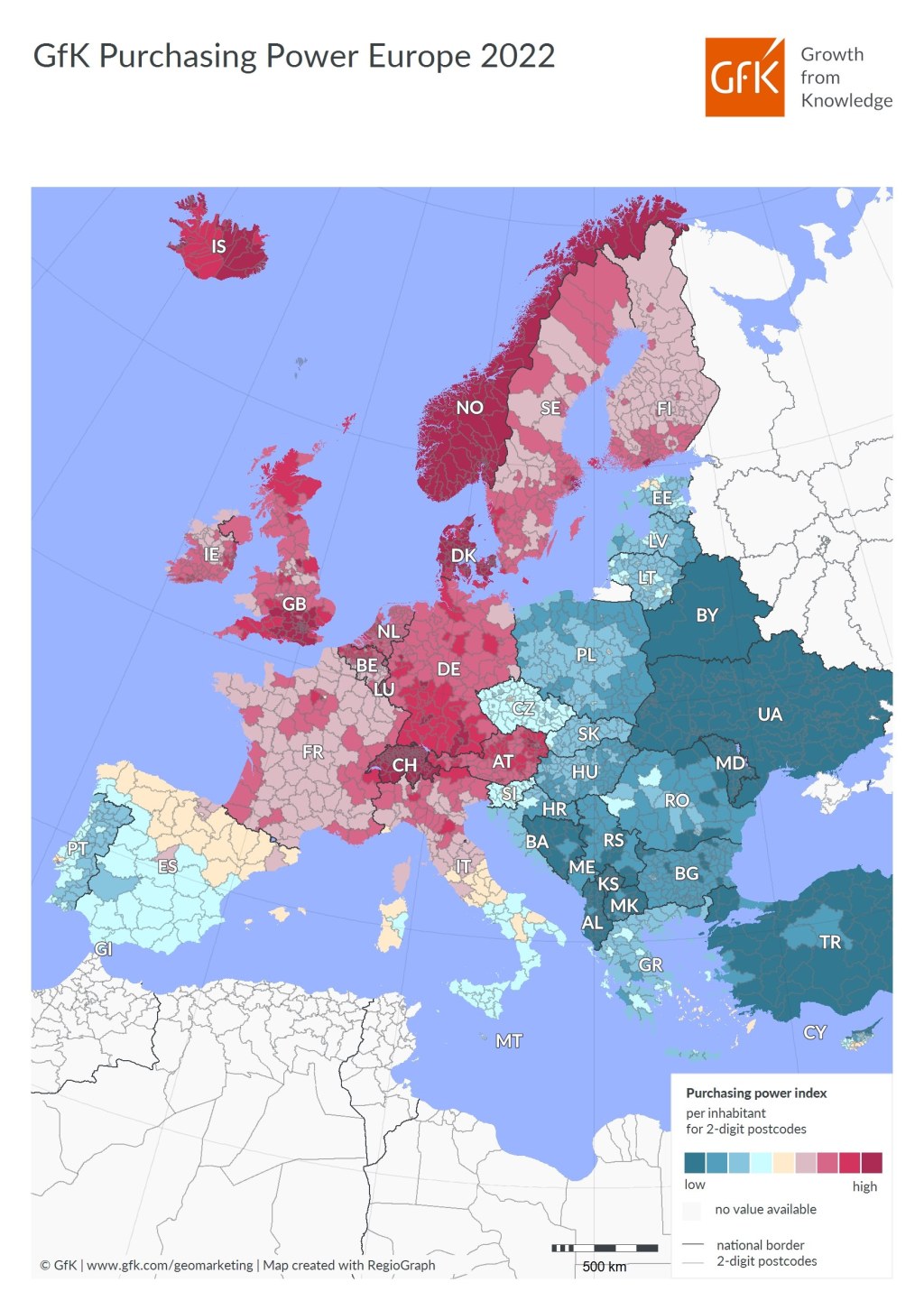

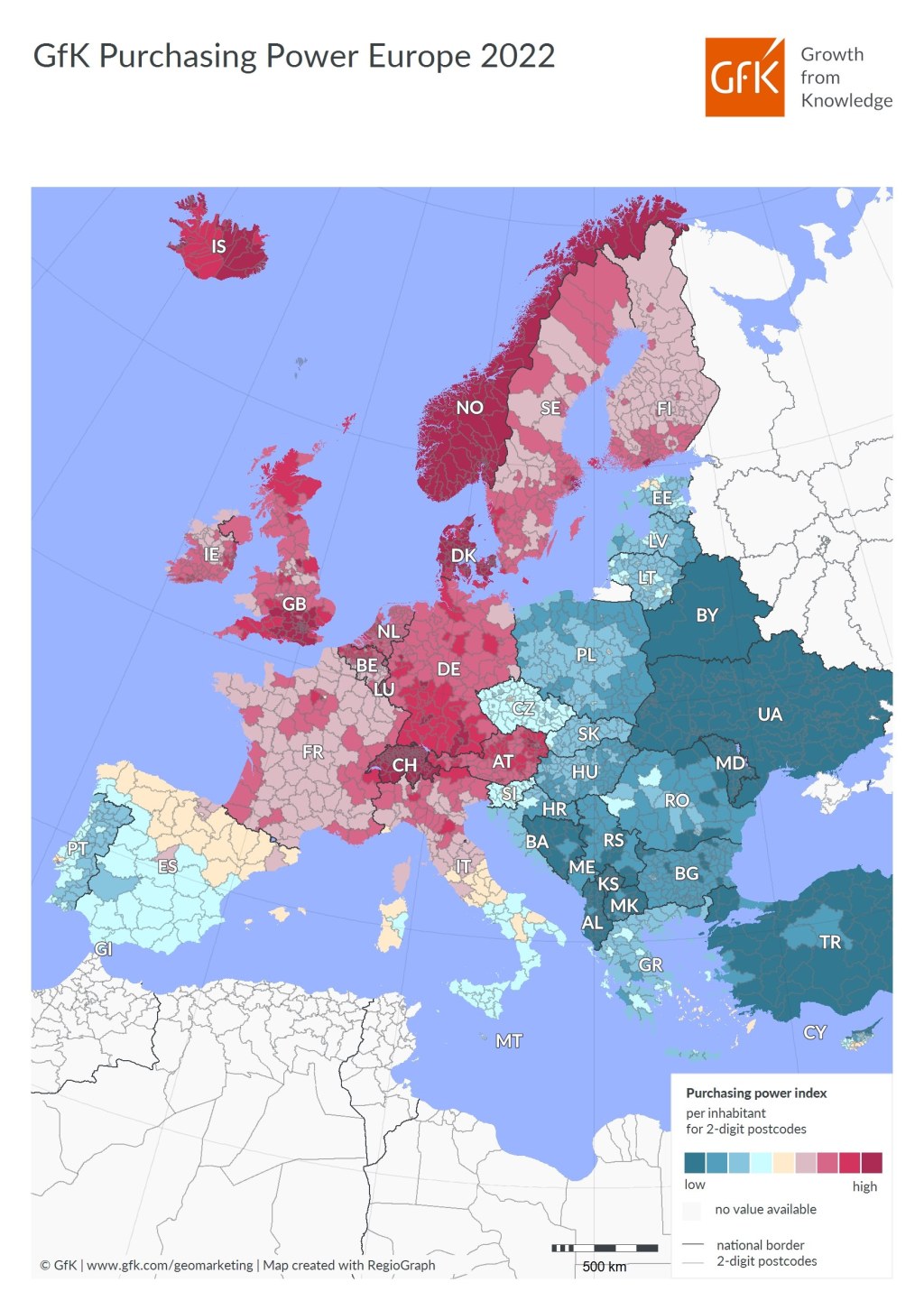

Image Source: gfk.com

Purchasing power savings refers to the ability of an individual or a household to maximize their buying potential by making smart financial decisions. It involves various strategies, such as budgeting, comparing prices, utilizing discounts and promotions, and seeking out cost-effective alternatives. By employing these techniques, consumers can stretch their money further and afford higher-quality goods and services.

How Does Purchasing Power Savings Work? 💡

To understand the workings of purchasing power savings, let’s consider an example. Imagine you have a budget of $100 to purchase groceries for the week. By carefully planning your purchases, comparing prices, and using coupons, you can make the most of your budget. This means you can buy more items or opt for higher-quality products within the same budget, effectively increasing your purchasing power. By consistently implementing such strategies, you can make significant savings over time.

Who Benefits from Purchasing Power Savings? 🤔

Purchasing power savings is beneficial to individuals from all walks of life. Whether you are a student on a limited budget, a young professional starting your career, or a retiree looking to make the most of your pension, understanding and implementing purchasing power savings strategies can greatly benefit you. By adopting these practices, you can achieve financial goals, build a secure future, and improve your overall quality of life.

When to Implement Purchasing Power Savings? ⌛

The sooner you start implementing purchasing power savings strategies, the better. It is never too early or too late to take control of your finances and make informed purchasing decisions. Whether you are making small everyday purchases or big-ticket investments, being mindful of your purchasing power can have a significant impact on your financial well-being. Therefore, it is advisable to start implementing these strategies as soon as possible.

Where Can Purchasing Power Savings Be Applied? 📍

Purchasing power savings can be applied to various aspects of our lives. It is not limited to specific products or services but can be implemented across different industries and sectors. Whether you are buying groceries, clothing, electronics, or even planning a vacation, understanding and utilizing purchasing power savings strategies can help you make the most of your budget.

Why is Purchasing Power Savings Important? 🌟

Purchasing power savings is important for several reasons:

Financial Stability: By maximizing your buying potential, you can achieve financial stability, reduce debt, and build wealth over time.

Higher-Quality Goods and Services: With increased purchasing power, you can afford higher-quality products and services that enhance your overall lifestyle.

Long-Term Savings: By consistently practicing purchasing power savings, you can accumulate significant savings that can be utilized for future investments or emergencies.

Increased Buying Options: By making smart financial decisions, you open yourself up to a wider range of purchasing options and can choose products or services that best meet your needs.

Reduced Financial Stress: By being aware of your purchasing power, you can make informed decisions and avoid unnecessary financial stress or impulsive purchases.

How Can You Implement Purchasing Power Savings? 📝

Implementing purchasing power savings requires a combination of careful planning, research, and disciplined financial habits. Here are some strategies you can consider:

Create a Budget: Establish a budget to track your income and expenses, ensuring that you allocate funds for savings and prioritize essential expenses.

Compare Prices: Research and compare prices from different retailers or online platforms to find the best deals and discounts.

Utilize Coupons and Rewards: Take advantage of coupons, loyalty programs, and cashback rewards to maximize your savings.

Consider Generic or Store Brands: Explore generic or store brands that offer similar quality products at a lower price compared to well-known brands.

Shop During Sales and Promotions: Plan your purchases during sale seasons or promotional events to take advantage of discounted prices.

Buy in Bulk: For frequently used items, consider buying in bulk to benefit from bulk discounts and long-term savings.

Avoid Impulse Buys: Practice self-discipline and avoid impulsive purchases by evaluating the necessity and long-term value of an item before buying.

Advantages and Disadvantages of Purchasing Power Savings

Advantages:

Financial Freedom: Purchasing power savings allow you to gain control over your finances and achieve financial freedom.

Increased Buying Power: By making smart purchasing decisions, you can afford higher-quality products and services.

Long-Term Savings: Consistent saving and budgeting can lead to significant long-term savings for future goals or emergencies.

Disadvantages:

Time and Effort: Implementing purchasing power savings strategies requires time and effort to research, compare prices, and plan purchases.

Limited Availability: Depending on your location or specific needs, it may not always be possible to find the desired products or services at a discounted price.

Impulsive Buying Temptations: Despite the best intentions, impulsive buying tendencies may still arise, leading to unnecessary expenses.

Frequently Asked Questions (FAQs)

1. Is purchasing power savings only relevant for low-income individuals?

No, purchasing power savings is relevant for individuals of all income levels. It is about making informed financial decisions and maximizing your buying potential, regardless of your income.

2. Can purchasing power savings strategies be applied to online shopping?

Absolutely! Online shopping provides ample opportunities for comparing prices, utilizing discounts, and finding cost-effective alternatives, making it an ideal platform for practicing purchasing power savings.

3. Are there any risks involved in purchasing power savings?

Purchasing power savings strategies do not involve significant risks. However, it is essential to be mindful of quality and durability when opting for cost-effective alternatives.

4. Can purchasing power savings help me save for a specific goal, such as a vacation or a down payment on a house?

Yes, by consistently implementing purchasing power savings strategies, you can accumulate significant savings that can be directed towards specific goals, such as a vacation or a down payment on a house.

5. How long does it take to see the benefits of purchasing power savings?

The benefits of purchasing power savings can be seen in the short term as you start making more cost-effective purchases. However, the long-term benefits, such as increased savings and financial stability, become more apparent over time as you consistently practice these strategies.

Conclusion

In conclusion, purchasing power savings is a valuable concept that can help you make the most of your hard-earned money. By implementing strategies such as budgeting, comparing prices, and utilizing discounts, you can enhance your buying potential and achieve financial stability. Start implementing these techniques today and experience the positive impact on your finances. Remember, every smart purchasing decision counts!

Final Remarks

Friends, it is important to note that while purchasing power savings can greatly benefit your financial well-being, it is essential to strike a balance between saving and enjoying the present. Prioritize your needs, evaluate the long-term value of your purchases, and make informed decisions that align with your financial goals. By doing so, you can maximize your purchasing power while leading a fulfilling and financially secure life.

This post topic: Shopping Savings