Seize The Opportunity To Purchase National Savings Certificate Online Now!

Purchase National Savings Certificate Online – A Safe and Convenient Investment Option

Hello Readers,

Welcome to our informative article on purchasing national savings certificates online. In this digital age, where everything is just a click away, investing in national savings certificates has become easier than ever. By buying these certificates online, you can secure your financial future conveniently. In this article, we will provide you with all the necessary information you need to know about purchasing national savings certificates online.

1 Picture Gallery: Seize The Opportunity To Purchase National Savings Certificate Online Now!

Table of Contents

1. Introduction

2. What are National Savings Certificates?

3. Who can Invest in National Savings Certificates?

4. When can you Purchase National Savings Certificates?

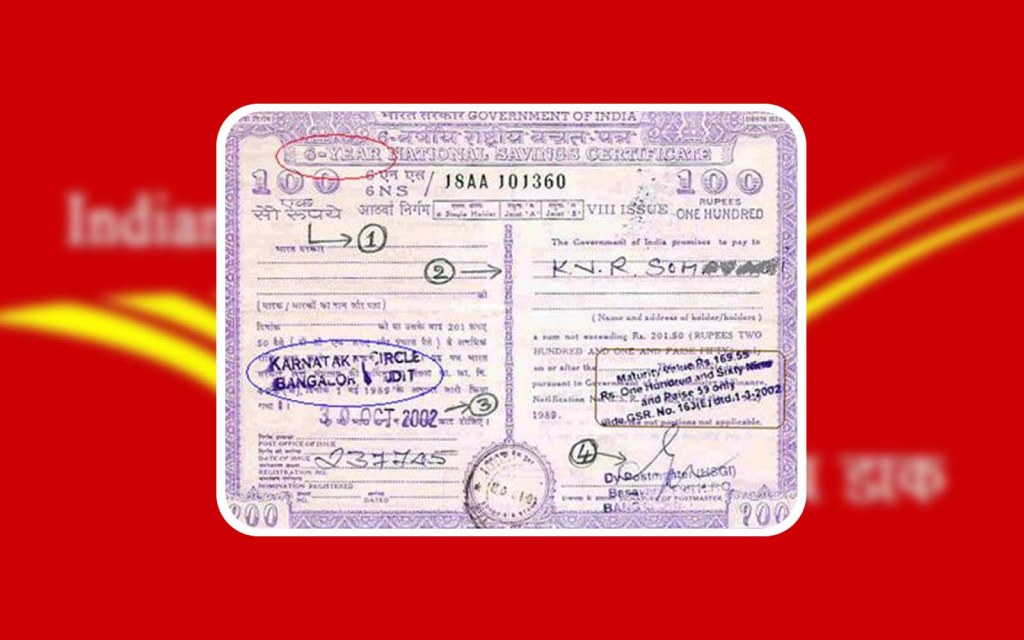

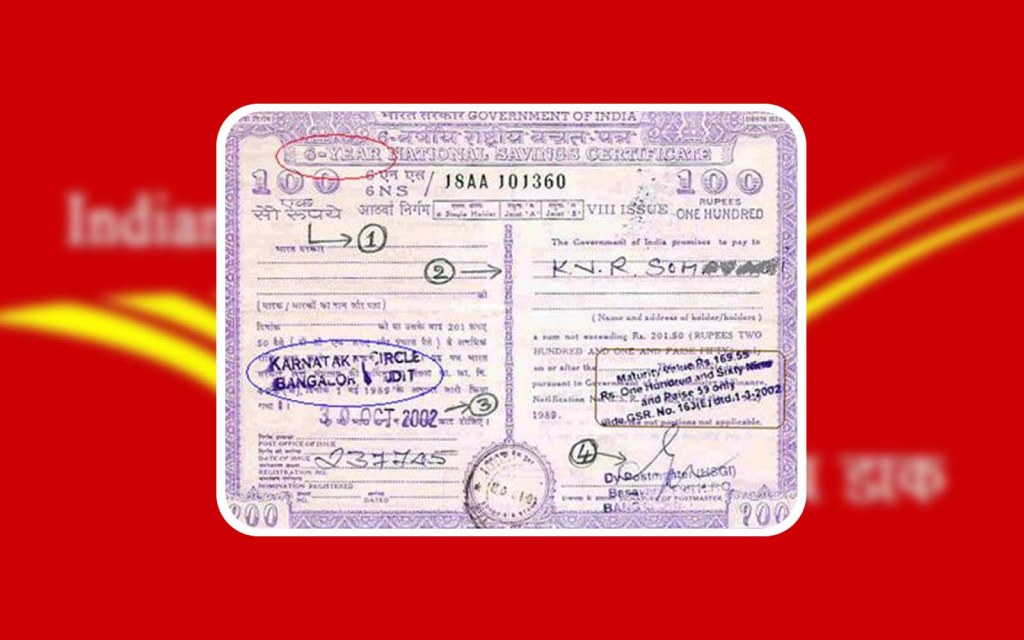

Image Source: paytm.com

5. Where to Buy National Savings Certificates Online?

6. Why Should You Invest in National Savings Certificates?

7. How to Purchase National Savings Certificates Online?

8. Advantages of Buying National Savings Certificates Online

9. Disadvantages of Buying National Savings Certificates Online

10. Frequently Asked Questions (FAQs)

11. Conclusion

12. Final Remarks

1. Introduction

Investing in national savings certificates is a wise decision as it offers a secure and reliable way to grow your savings. These certificates are issued by the government and provide attractive interest rates. By purchasing these certificates online, you can enjoy the convenience of digital transactions and manage your investments efficiently.

In this article, we will guide you through the process of purchasing national savings certificates online, including how and where to buy them, who can invest, the advantages and disadvantages, and frequently asked questions. So, let’s dive in and explore the world of online investment in national savings certificates.

To assist you in making an informed decision, we have compiled all the necessary information in the following sections. Read on to learn more about national savings certificates and how you can purchase them conveniently from the comfort of your own home.

2. What are National Savings Certificates?

National Savings Certificates (NSCs) are a type of government-backed savings scheme that individuals can invest in. These certificates offer a fixed interest rate, making them an attractive option for those looking to grow their savings securely. NSCs are considered a safe investment as they are backed by the government, providing investors with peace of mind.

These certificates have a predetermined maturity period, typically ranging from 5 to 10 years. Investors receive interest on their investment annually, which is added to the principal amount. The interest earned on NSCs is eligible for tax benefits under Section 80C of the Income Tax Act, making them even more appealing to investors.

Now that we have a basic understanding of what national savings certificates are, let’s proceed to the next section to find out who can invest in these certificates.

3. Who can Invest in National Savings Certificates?

NSCs are available to both resident Indians and Non-Resident Indians (NRIs). Individuals above the age of 18 can invest in national savings certificates either individually or jointly. Parents or guardians can also invest on behalf of a minor. However, NRIs cannot purchase NSCs online and need to visit a post office branch to make their investment.

It is important to note that NSCs come with a lock-in period, during which the certificates cannot be encashed or transferred. The lock-in period for NSCs is 5 years. After the completion of the lock-in period, investors can choose to reinvest the maturity amount or withdraw it as per their financial requirements.

Now that we know who is eligible to invest in national savings certificates, let’s move on to the next section to understand when you can purchase these certificates.

4. When can you Purchase National Savings Certificates?

National savings certificates can be purchased at any time throughout the year. Unlike other investment options where the interest rate may fluctuate, NSCs offer a fixed interest rate that remains constant. The interest rate for NSCs is revised periodically by the government, and the new rate is applicable to investments made after the revision.

It is essential to stay updated with the latest interest rates when considering investing in NSCs. The interest rate, lock-in period, and maturity period are crucial aspects to consider before making your investment. By purchasing NSCs during periods of higher interest rates, you can maximize your returns.

Now that we have explored the timing aspect of purchasing national savings certificates, let’s move on to the next section to discover where you can buy these certificates online.

5. Where to Buy National Savings Certificates Online?

Purchasing national savings certificates online is a hassle-free process. You can buy these certificates directly from the official website of the Department of Posts, Government of India. The website provides a dedicated portal for individuals to invest in NSCs online.

To purchase national savings certificates online, you need to have a savings account with a designated bank that offers online investment facilities. Once you have registered on the Department of Posts’ website and linked your savings account, you can proceed with the online investment process.

Now that we know where to buy national savings certificates online, let’s move on to the next section to understand why investing in these certificates is beneficial.

6. Why Should You Invest in National Savings Certificates?

Investing in national savings certificates offers several advantages that make them an attractive investment option for individuals looking to grow their savings securely. Let’s explore some of the key reasons why you should consider investing in NSCs:

6.1 Guaranteed Returns:

NSCs provide guaranteed returns as they are backed by the government. The interest rate remains fixed throughout the certificate’s tenure, ensuring a steady income stream for investors.

6.2 Secure Investment:

Being a government-backed investment, NSCs are considered highly secure. The principal amount invested, along with the interest earned, is guaranteed by the government, reducing the risk associated with investing in other financial instruments.

6.3 Tax Benefits:

The interest earned on NSCs is eligible for tax benefits under Section 80C of the Income Tax Act. This allows investors to save on their tax liabilities while growing their savings.

6.4 Fixed Interest Rate:

The interest rate on NSCs remains fixed throughout the certificate’s tenure. This ensures that investors know the exact returns they will receive at the end of the maturity period, making financial planning easier.

6.5 Encourages Regular Savings:

Investing in NSCs encourages individuals to save regularly. The fixed maturity period of these certificates instills discipline in investors and helps them develop a habit of saving.

6.6 Diversification of Investment Portfolio:

Adding national savings certificates to your investment portfolio can help diversify your risk. NSCs offer stable returns, making them an excellent addition to a well-rounded investment strategy.

6.7 Easy Liquidity:

While NSCs have a lock-in period of 5 years, they offer easy liquidity options after the completion of this period. Investors can choose to reinvest the maturity amount or withdraw it as per their financial requirements.

Now that we have learned about the advantages of investing in national savings certificates, let’s proceed to the next section to understand the process of purchasing these certificates online.

7. How to Purchase National Savings Certificates Online?

Purchasing national savings certificates online is a simple and convenient process. Here’s a step-by-step guide to help you navigate through the online investment process:

7.1 Step 1: Open a Savings Account

If you don’t have a savings account, open one with a designated bank that provides online investment facilities for national savings certificates.

7.2 Step 2: Register on the Department of Posts’ Website

Visit the official website of the Department of Posts, Government of India, and register yourself as a user. Provide the necessary details and create your account.

7.3 Step 3: Link your Savings Account

Link your savings account to the Department of Posts’ website. This will enable you to make online transactions and investments seamlessly.

7.4 Step 4: Choose the National Savings Certificate Option

After successfully linking your savings account, select the national savings certificate option from the available investment options.

7.5 Step 5: Fill in the Required Details

Provide the necessary details such as the amount of investment, maturity period, and nominee details. Ensure that all the information is accurate and up-to-date.

7.6 Step 6: Make the Payment

Proceed with the payment for your national savings certificate investment using your linked savings account. Verify the transaction details and confirm the payment.

7.7 Step 7: Confirmation and Certificate Generation

After successful payment, you will receive a confirmation of your investment along with the generated national savings certificate. Save these documents for future reference.

Congratulations! You have successfully purchased national savings certificates online. Now let’s move on to the next section, where we will discuss the advantages and disadvantages of buying these certificates online.

8. Advantages of Buying National Savings Certificates Online

8.1 Convenience:

Buying national savings certificates online offers the convenience of investing from anywhere, anytime. You can make your investment at your own pace without visiting a physical post office.

8.2 Time-saving:

Online investment in national savings certificates saves you time and effort. You can complete the entire investment process within a few minutes, eliminating the need for lengthy paperwork.

8.3 Transparency:

When purchasing national savings certificates online, you have complete transparency regarding the investment process, interest rates, and terms and conditions. All the details are available on the official website.

8.4 Easy Tracking:

By investing online, you can easily track the performance of your national savings certificates. The Department of Posts’ website provides a dashboard where you can monitor your investments and view the generated certificates.

8.5 Secure Transactions:

Online transactions for purchasing national savings certificates are secured with encryption and multi-factor authentication. This ensures the safety of your personal and financial information.

9. Disadvantages of Buying National Savings Certificates Online

9.1 Limited Accessibility:

Not all banks offer the facility to invest in national savings certificates online. Therefore, the accessibility of online investment may be limited to certain banking institutions.

9.2 Technical Glitches:

As with any online transaction, technical glitches or internet connectivity issues can disrupt the investment process. It is important to have a stable internet connection and keep your devices updated.

9.3 Limited Assistance:

When investing online, you may have limited assistance available compared to visiting a physical post office. If you require personalized guidance or face any issues, reaching out to customer support may be necessary.

9.4 Cybersecurity Risks:

While online transactions are generally secure, there is always a risk of cybersecurity threats. It is crucial to ensure that you are using a reliable and secure network when making online investments.

9.5 Lack of Physical Documentation:

When buying national savings certificates online, you may not receive physical copies of the certificates. While the generated certificates are digitally signed and valid, some individuals prefer having physical copies for their records.

Now that we have discussed the advantages and disadvantages of purchasing national savings certificates online, let’s move on to the frequently asked questions section.

10. Frequently Asked Questions (FAQs)

10.1 Can NRIs Invest in National Savings Certificates Online?

No, NRIs cannot purchase national savings certificates online. They need to visit a post office branch to make their investment.

10.2 Can I Withdraw my Investment before the Maturity Period?

No, national savings certificates have a lock-in period of 5 years. You cannot encash or transfer them before the completion of this period.

10.3 Can I Nominate Multiple Individuals for my National Savings Certificates?

No, you can nominate only one individual for your national savings certificates. This nominee will receive the maturity amount in case of the investor’s demise.

10.4 Is the Interest Earned on National Savings Certificates Taxable?

Yes, the interest earned on national savings certificates is taxable. However, it qualifies for tax benefits under Section 80C of the Income Tax Act.

10.5 Can I Transfer my National Savings Certificates?

No, national savings certificates cannot be transferred. They are non-transferable financial instruments.

Now that we have answered some frequently asked questions, let’s proceed to the conclusion of our article.

11. Conclusion

Investing in national savings certificates online is a safe and convenient option to grow your savings. With guaranteed returns, tax benefits, and easy liquidity options, these certificates provide a secure investment avenue for individuals looking to secure their financial

This post topic: Shopping Savings